On January 1, 2020, bitcoin was trading at $7,160. The Dow Jones was also trading at 28,634 on January 3, 2020, before crashing to 19,173 on March 20, 2020, after the coronavirus pandemic broke out in the United States. States and the Federal governments immediately shut down the economy and millions of people lost their jobs.

As part of its effort to stimulate the economy, the U.S. government issued stimulus checks to millions of employed Americans. Where did the money come from? The government had to borrow by selling its debt in the form of U.S. Treasury bonds and other types of securities. The after the bonds are sold, the Federal Reserve gets to work and starts printing money.

You are watching: 40% of US dollars in existence were printed in the last 12 months: Is America repeating the same mistake of 1921 Weimar Germany?

But money printing is not new. The Federal Reserve has been printing money to pay for about $29 trillion in U.S. debt. However, what’s new is that the 40% of US dollars in existence were printed in the last 12 months alone.

What is so ironic about this number is that just two years ago, Federal Reserve reported that 40% of Americans don’t have $400 in the bank for emergency expenses, according to a report from ABC News. The 2019 Federal Reserve survey finds that almost 40% of American adults wouldn’t be able to cover a $400 emergency with cash, savings, or a credit card charge that they could quickly pay off.

Read more : Stamp Announcement 21-21: Western Wear Stamps

The US government has been printing massive amounts of new money. On January 6, 2020, the US Federal Reserve had around $4 trillion dollars. On January 4, 2021, the number increased to $6.7 trillion dollars. Money is usually a medium of change to facilitate the sale, purchase, or trade of goods between buyers and sellers. However, since there is no productivity (good and services) to back up the trillions of dollars currently in circulation, printing more money doesn’t necessarily increase the economic output (productivity), it only increases the amount of money circulating in the economy.

Who cares? You may ask. It leads to inflation and devaluation. Too much money in circulation chasing the same amount of goods leads to inflation. For example, inflation rose 0.8% in April and 4.2% on an annual basis, the highest spike since 2008 driven in part by a huge increase in food prices and others. The impact of inflation can also be seen in stocks and cryptocurrencies.

Remember the three stimulus checks issued to millions of struggling Americans? Instead of spending the money on food, savings, or paying off debts, some people invested their stimulus checks in stocks (GameStop, etc.), and cryptocurrencies like bitcoins further driving up their prices.

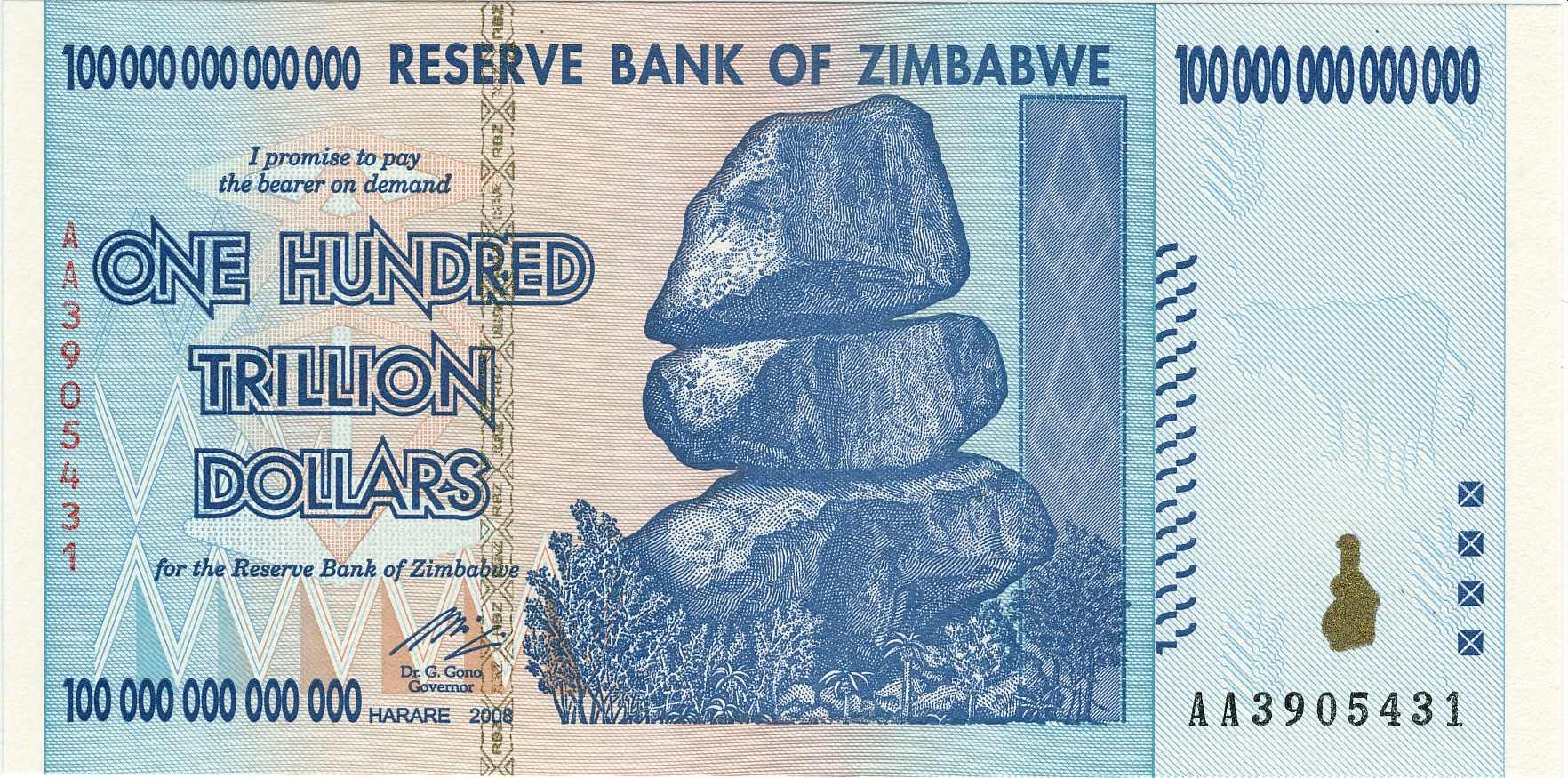

The other problem with the Fed printing too much money is that it leads to the debasement and the devaluation of the dollars. What the Fed is doing now has been tried throughout history. The outcome is always the same. Take, for example, Germany. Between June 1921 and November 1923 in Weimar Germany, the highest monthly inflation rate rose by over 30,000%. Zimbabwe is another country with hyperinflation.

Read more : Animal Baby Shower Invitations

In the video below, Jake Tran takes us on a journey through the history of countries that have tried to print their way out of the economic crisis only to find themselves in deeper economic woes. Jake also added that the reason why we haven’t seen inflation is because the amount of money being printed is only one of the factors that contribute to inflation.

To get inflation, Jake explains, we need: 1. Industrial Output: How much “stuff” an economy makes 2. Employment: Too much employment leads to employers fighting over workers, which leads to higher wages, which leads to higher prices 3. The Money Supply: More money when an economy is producing the same amount or less stuff equals higher prices 4. Velocity of Money: If money is exchanging hands, and if so, how fast is it exchanging hands.

Hats off to Jake for putting this video together. Enjoy!

1921 Weimar Germany

Zimbabwe

Source: https://antiquewolrd.com

Categories: Stamps